|

| Issues with supplies of HCFC-22 are causing more attention to the reclaim option as was the case with this display at the AHR Expo in Chicago. |

How much HCFC-22 will be available to contractors in 2012 is an unanswered question as the Environmental Protection Agency (EPA) considers a faster phaseout of HCFCs.

The EPA began the year by issuing a 75-page proposal called Protection of Stratospheric Ozone: Adjustments to the Allowance System for Controlling HCFC Production, Import, and Export.

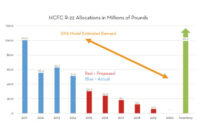

When and if the proposal takes effect, it would allow less virgin HCFCs to come to market than the previous phasedown announced on Jan. 1, 2010. The previous rule allocated 45.4 KT (100 million pounds) in 2011 and 40.7 KT (90 million pounds) of R-22 for 2012. In this latest proposed rule, the EPA could reduce the quantity available for production and import in 2012 to between 25.1 to 36.2 KT (55 million to 80 million pounds).

The latest proposal from EPA says that the phasedown will range from 11 to 47 percent per year beginning in 2012 and ending in 2014, which is in addition to the 10 percent annual reduction built into the previous rule.

A Proposal for Now

The proposal is just that — a proposal. Comments were invited through Feb. 3, but the EPA may not issue a final ruling until summer.

However, the delay in issuing solid production numbers has led to a period of confusion in the industry. For three weeks, production and importation was not allowed until the EPA issued a non-enforcement letter on Jan. 20 saying the agency would not fine producers as long as they do not exceed the amount of allowances outlined in the letter. The letter said producers and importers combined cannot exceed 55 million pounds for 2012, a 45 percent reduction from 2011, while the EPA finalizes the rule.

As producers resumed production, there were reports of price increases. At the same time R-22 manufacturers were looking at allocation options for their own wholesaler customers.

Richard Rowe, global group president for Arkema, said in late January that Arkema would strive “to serve existing customers with [the amount] of refrigerant they had used in the past for as long as possible during the phaseout of R-22.”

Lincoln Germain, global business director of heat transfer and fluorine products for Honeywell, also noted Honeywell’s focus on current customers and said, “We will not be accepting new customers.”

Jim Bachman, national sales and marketing manager for DuPont Refrigerants, said, “DuPont’s focus is on ensuring supply to our existing, loyal distributors and their downstream customers. Clearly, though, we feel it’s extremely important that industry participants focus on implementing plans to reduce their dependence on R-22 as soon as possible.”

All this factored into a comment from Jay Kestenbaum, senior vice president for product management at Airgas, who stressed the importance of those who deal with refrigerants to rely on “reliable, solid suppliers.” He noted the situation “is not new to our industry as we have seen similar situations during the phaseouts of CFCs, and more recently during shortage periods for HFC-134a in 2005, and just last year during the worldwide shortages of all HFC-125 based blends.”

Reasons for a Faster Phasedown

Those who have followed the issue closely point to several reasons that may be behind the EPA’s proposal to speed up the HCFC phasedown. These include the following:

• The EPA’s concern over a lack of adequate reclamation of R-22, whose reuse is not factored into virgin allocations.

• The agency is perhaps upset over the industry’s aggressive use of an allowance in the 2010 ruling that permits dry-shipping of R-22 components such as condensing units — this despite the fact that many in the industry have campaigned to have the EPA close the so-called loophole.

• The fact that the industry did not use its entire 2010 allocation of R-22 in part because of a sluggish economy and OEM focus on HFC refrigerants in new equipment.

The HFC Aspect

Another aspect of the equation is that nearly all refrigerant manufacturers capable of making virgin R-22 are also manufacturing a wide range of HFC refrigerants that can be retrofitted into R-22 systems — and those HFCs are not subject to any phasedown. Refrigerant manufacturers have been promoting wider use of such refrigerants for a number of years.

In fact, during the AHR Expo in late January in Chicago, a number of manufacturers referenced that.

For example, Gordon Mc-Kinney, vice president and CEO of ICOR International, said, “If HCFC pricing increases at the pace that many predict it will, refrigerant users and equipment owners will be quickly adjusting their own priorities. Many are already ahead of the curve and well acclimated to using R-22 alternatives.”

A statement from Honeywell said, “As R-22 supplies become more expensive and supplies tighten, many of our customers will be looking for alternatives to R-22 to retrofit into their systems.”

DuPont’s Bachman said, “It is critical to consider the impact of the R-22 supply reductions on your business and the benefits that R-22 replacement refrigerants can provide to equipment owners. HFCs offer a viable alternative to R-22.”

And all continued to urge contractors to make more use of the numerous refrigerant reclamation options in place, which allow recovered R-22 to be brought back to ARI-700 purity standards and reintroduced to the market without being counted as part of the virgin R-22 allocations.

Gauging Supply

With the industry currently assuming 55 million pounds — rather than the 90 million pounds anticipated — coming to market in 2012, the question of shortages is being brought up.

Honeywell’s Germain said in late January he anticipates “spot” shortages through 2012.

Jonathan Melchi, director of government affairs for the Heating, Airconditioning, and Refrigeration Distributors International (HARDI), a wholesaler trade association, said he did believe the market would tighten yet does not anticipate a large shortfall through 2012. He credited this to large supplies of R-22 currently being held by wholesalers and their customers, as well as a still sluggish economy.

DuPont’s Bachman said, “The reductions in the proposed rule are significant and major changes in business practices are necessary to avoid a supply shortfall.”

However the allocation situation plays out, there is general support for the willingness of the EPA to set up a timeline for continual phasedown through 2014, although there are differing views on what the percentages should be. And it was noted that even though the phaseout is being sped up, there still appears there will be some virgin R-22 available until the spigot is turned off in 2020, except for a 0.5 percent trickle continuing to 2030.

Publication date: 02/06/2012