|

| The days may be numbered for the charging of systems with virgin R-22 as the EPA continues to tighten supplies, leading to a greater reliance on reclaimed R-22 and alternative refrigerants. |

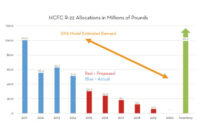

The total allowances for virgin R-22 for 2013 are 39 million pounds. That compares with 55 million pounds of new product in 2012 and 100 million pounds in 2011. And, by comparison, in 1999, the base year for all current measurements of supplies, refrigerant manufacturers were bringing more than 300 million pounds of virgin R-22 to the market.

“The latest ‘No Action Assurance’ letters extend and modify similar letters issued last year and allow companies to continue to produce and import R-22 and R-142b in the coming year,” said Charlie McCrudden, vice president for government relations, Air Conditioning Contractors of America (ACCA).

In effect, No Action Assurance letters from the EPA tell producers that they will not face fines and penalties if they keep production of new HCFCs at or below certain levels.

“The letters are necessary because the EPA has not finalized a long-pending rule that would grant the authority to produce HCFCs, known as the 2012-2014 Allocation Adjustment Rule,” said McCrudden.

McCrudden did say there could be an uptick in that 39 million target. “The EPA has yet to complete its proposed 2012-2104 Allocation Adjustment Rule. When it does, there will likely be at least 6.5 million pounds added to the 2013 allocation, which would make the total year-to-year reduction closer to 15 percent. This will be part of an adjustment required to recoup allocation losses by two HCFC producers who had completed a legal trade of allocations that EPA had failed to recognize in a previous allocation rule.”

According to McCrudden, a final ruling may not come until April.

Wake Up Call?

Whatever the final number, it will be well below the numbers established in 2012, and that is leading refrigerant suppliers to advise contractors and their customers to potentially look beyond R-22.

Gordon McKinney, vice president and COO, ICOR International, called the EPA No Action Assurance “a light switch” moment.

“Many realized at that very moment that R-22 would no longer be the most practical option for maintaining the enormous amount of R-22 systems in operation today,” he said. “Within hours of the news, the market reacted with substantial price increases.

“The consensus is that 2013 will be the first year that we will not have enough R-22 to satisfy the industry’s service requirements. This notion is quickly sinking in with distributors and their refrigerant customers.”

At the same time, National Refrigerants’ Maureen Beatty believes R-22 supplies, in some cases, may be adequate for the time being.

“While every wholesaler will not have R-22 to sell, and some who have it will not have as much as they had previously, it is our intent to continue to supply our customers with all of their R-22 needs as they continue to service existing equipment while properly planning for an orderly transition to non-ODS [ozone depleting substance] refrigerants.”

Other refrigerant manufacturers have issued similar statements to their customers.

Alternatives

As has long been the case, those involved in refrigerants have been promoting two primary alternatives to new R-22 or R-22 drop-in replacements — recovering and reclaiming R-22 for reuse in existing systems and/or the use of HFC-based refrigerants.

In noting that a final pound count from the EPA may not come for several months, Jay Kestenbaum, senior vice president of product management, Airgas, said, “It means that the season will have to operate at the drastically reduced numbers well below last year’s quantities. We do believe that these reduced amounts will result in some true tightening of the market and a significant drive by the industry to make more products available only through reclamation of recovered refrigerants.

“The industry does have the tools in place to recover and reclaim substantially greater amounts than are currently being put through industry reclamation facilities. We are confident that with the additional new push by the EPA, all users will realize how necessary it is to recover every pound in order to provide the inventory that will be needed for many years,” he said.

While Kestenbaum is inclined to mitigate depleted R-22 supplies through reclamation and alternative refrigerants, he acknowledges that this will come at a price.

“The supply allowance [of new R-22], along with some additional product that clearly is in inventory already, added to the additional amounts from reclamation, should be enough to cover current market needs. However, we do fully expect continually rising prices that not only cover the increasing costs of operating manufacturing facilities with smaller output, but also the enormous cost of funds needed for development of next-generation alternative products well beyond HCFCs and HFCs.”

However things play out, contractors should continue to realize that R-22 is not a long-term alternative.

A DuPont statement noted that the company continues, “to emphasize to contractors the importance of being prepared for the R-22 phaseout and to realize that the phaseout has been accelerated. Virgin R-22 supply has been significantly reduced and contractors are starting to reduce their dependence on R-22. Being prepared includes working with end users to have a good refrigerant management plan in place that includes retrofitting to R-22 alternatives.”

Dynatemp International had a similar comment. “With recent EPA mandates shrinking the supply of R-22, the price of R-22 has risen considerably. As we move closer to the eventual full phaseout of R-22, it will become increasingly important for our wholesale customers to have an alternative refrigerant to offer service technicians out in the field.”

But are enough alternatives there?

Steve Mella, CEO of Comstar International Inc., noted, “The pipeline for R-22 replacements is virtually empty and catch up will come slowly. This will put more pressure on the price of R-22 to stay high and even increase until the R-22 replacements start filling the pipeline.”

In a statement from Honeywell, it was noted, “The EPA is on a path to reduce HCFCs by a minimum of 90 percent from the baseline by 2015, to comply with the Montreal Protocol. Supplies of R-22 will continue to tighten as a result.”

Supplies are limited, and dwindling fast. And, it appears as if that trend is only set to continue.

Publication date: 2/4/2013