COLUMBUS, Ohio—Heating, Air-conditioning & Refrigeration Distributors International (HARDI) released its monthly TRENDS report, showing average sales for HARDI distributor members declined by 3.3 percent in May 2015.

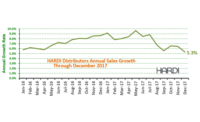

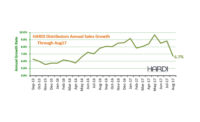

The annualized growth through May 2015 was 5.1 percent. This is the slowest annual growth rate in more than a year, but the recent softness is largely attributed to poor weather in much of the country.

“The weather was not conducive to construction activity or air conditioner sales across much of the country in May,” said HARDI Market Research and Benchmarking Analyst Brian Loftus. “This pulled down the national annual growth rate, but four of the seven regions have experienced growth faster than 5.1 percent.”

Weather can be a major driver of HVACR sales. That is why May is traditionally one of the peak months for industry sales. “When California has 22 cooling degree days this year versus 83 in May 2014, or Arizona has 200 this year versus 306 last year, that will have a recognizable impact on the results,” said Loftus.

Flooding in the Southwest was featured in news reports for much of May and data from the National Oceanic and Atmospheric Association quantify those events. Much of the region from Texas to North Dakota and Minnesota accumulated at least four inches above normal May rainfall and, in many areas, eight inches greater than normal.

The Days Sales Outstanding (DSO), a measure of how quickly customers pay their bills, is now at 50.1. “As sales accelerate into the peak May-June-July period, DSO typically approaches 45,” said Loftus.

May, June and July compose the peak selling season for HARDI distributors and are traditionally responsible for more than 30 percent of annual sales. This is more pronounced in the Southwest and West and extends into August. “It will be very interesting to see if the weather postponed activity or if annual growth is in a new lower range,” said Loftus.

HARDI members do not receive financial compensation in exchange for their monthly sales data and can discontinue their participation without prior notice or penalty. Participation is voluntary, and the depth of market coverage varies from region to region. An independent entity collects and compiles the data that can include products not directly associated with the HVACR industry.