At the beginning of 2019, many economists predicted that the economy would soften by the end of the year, but according to commercial refrigeration contractors, that did not happen. At least not in their industry, as they had more than enough work in supermarkets, restaurants, and convenience stores to keep them busy until the end of the year and beyond.

Business might have been even stronger if they could have hired more people to do the work. Unfortunately, the lack of labor continues to be a significant problem in the HVACR industry, and there is no relief in sight.

LOOKING FOR LABOR

Finding new technicians is, and probably always will be, a big challenge for the industry, said Todd Ernest, CEO of Climate Pros, Glendale Heights, Illinois. In fact, even though the company was able to hire 150 new technicians last year, he said they could have hired 300. Even so, the company had a great year in 2019.

“We had tremendous growth across multiple states, and we also completed four acquisitions to help us expand into new states,” he said. “We also had a lot of opportunities with new customers, and we continue to grow with our existing clientele. We recently more than doubled our business with one particular customer, taking over their entire chain of stores, which is unheard of in this industry.”

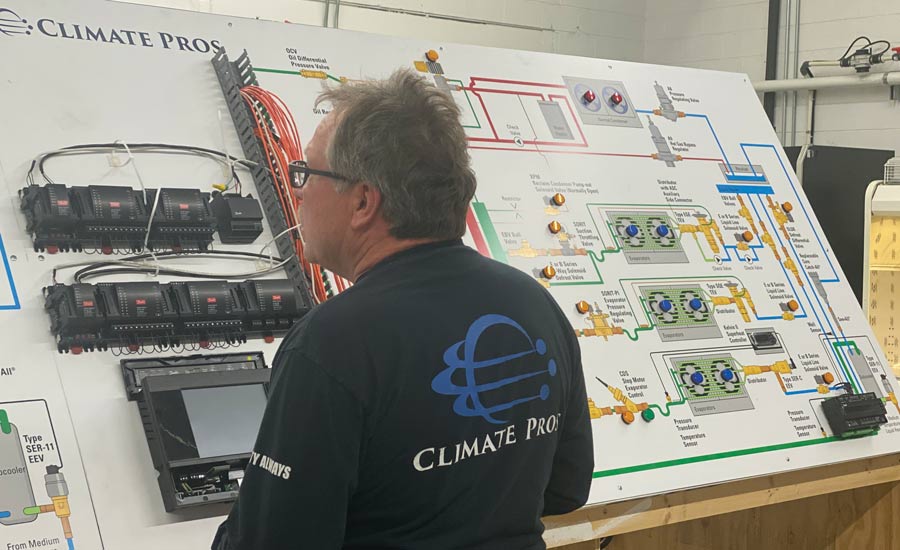

In order to keep up with all this growth, Climate Pros works hard to attract new talent. To that end, it offers a program called Climate Pros University, which is designed to take individuals with little or no commercial refrigeration experience and train them to be technicians within a year.

“By taking these young folks under our wing and bringing them through our program, we find that this builds loyalty and a sense of pride to work for Climate Pros,” said Ernest. “We are also a company of great benefits. We pay our employees’ insurance premiums at 100 percent, have great dental and vision, and offer a 401K with a matching program. We find that having a great benefits program helps attract and keep employees as well.”

Jim Pape, CEO of The Arcticom Group, Walnut Creek, California, agrees that attracting and retaining talented field personnel remains a very challenging aspect but that offering a robust benefits package definitely helps entice people to join the industry.

“The scaled providers, like The Arcticom Group, have a distinct advantage in this, because we can typically provide very competitive benefits, better work/life balance, technical and soft skills training, and a more stable future,” he said. “Our approach is simple: we strive to be the employer of choice in all our markets and deliver respectful leadership and a trusting environment.”

The Arcticom Group also had a great year in 2019, said Pape, as customers continued to find value by working with commercial refrigeration companies such as theirs, which can provide a high level of service over larger geographic areas.

“Our biggest challenges involve scaling up to meet the demand while ensuring that we are providing a very high level of service,” he said. “Concurrently, we must make our customers’ jobs easier by working to their often-complicated processes.”

The labor shortage is also a continual concern for Ron Brown, vice president of sales at Zone Mechanical in Alsip, Illinois, who said it will remain a pressing problem for the foreseeable future. His company is a union shop, and even though that comes with extensive apprenticeship programs and robust benefits, finding technicians is still a problem.

“I’m surprised the younger generation isn’t attracted to this industry,” he said. “You can be in your mid-20s and make $100,000 a year with a pension and fabulous benefits and work 40 hours a week with no student loans. You would think there’d be people lined out the door. Even with the labor shortage, though, we still had a record year this year, and we’re anticipating even more growth next year.”

Finding qualified technicians continues to be a high priority for Don Jones, refrigeration service supervisor at Electric Motor Repair, located in Baltimore, Maryland. In order to find new technicians, the company uses social media platforms, job hunting websites, job fairs, and word of mouth.

“In Maryland, employers can also take advantage of a tax break for apprentices who are enrolled in an approved program,” he said. “This is an effort to attract more employers to help with the training of new tradesmen. In the future, I see this program getting larger and expanding as it gains in popularity.”

REFRIGERANT ISSUES

In addition to the labor shortage, refrigerants continue to be a source of concern for both supermarket owners and contractors. Even though some states, such as California, have implemented their own HFC phasedown schedules, the federal government has not yet acted, so there is much uncertainty about what could happen. Many end users also still have equipment that utilizes R-22, the production and import of which has ceased as of January 1, 2020, so for both issues, contractors must help customers figure out the best solution going forward.

“The majority of our customers — about 80 percent — still have some degree of R-22 exposure,” said Pape. “The cost uncertainty is the major issue facing this portion of the market. R-22 is double what it used to cost, and the likelihood that it could double again presents a high degree of uncertainty for our customers short- and medium-term budgeting.”

However, changing over to ultra-low GWP refrigerants could be cost prohibitive for many customers. As Pape noted, some of the currently discussed GWP thresholds are very low, and the costs of retrofitting the average supermarket would be extremely high.

“The costs are so high, in fact, that some smaller or less financially solvent customers could be put in very bad financial positions,” he said. “However, the majority of our customers are making the switch to natural refrigerants or else working to reduce total system charge to get below the 50-pound limit imposed by the California Air Resources Board (CARB).”

About 30 percent of Ernest’s customers still use HCFCs, but he does not think the phaseout of R-22 will cause any problems, as many have been preparing for it for years. However, that does not mean that customers are switching to ultra-low GWP solutions, such as CO2.

“Some are testing new stores with CO2 in an effort to reduce their carbon footprint, but most are still waiting to see what happens,” he said. “There has been an increase year-over-year for the last four years of retailers building more CO2 stores, but many have just chosen to retrofit to an HFO. Others are doing nothing — it’s a really mixed bag.”

Brown has also noticed that customers are much less interested in refrigeration systems that utilize natural refrigerants than they used to be, which he attributes to the courts striking down the Environmental Protection Agency’s (EPA’s) HFC phasedown schedule.

“A few years ago, we were selling a lot of CO2 systems, but when the government backed off delisting some refrigerants, that really took the wind right out of the sails for natural refrigerants. At least in the Midwest,” he said. “Store owners are still getting rid of R-22, but the cost of HFCs such as R-507 and R-407 is cheaper than we have ever bought it, so there’s no incentive to change to a greener solution. I wish people were switching, but that’s not what we’re seeing.”

TRENDS

One issue that Brown is seeing is the dwindling number of independent grocery stores, many of which have been bought out by the big chains such as Kroger. For refrigeration contractors, this can result in an opportunity or a challenge, depending on whether the larger company decides to hire its own technicians.

“When a big chain gets new leadership, they either think they can do the maintenance cheaper themselves, or else they want to reduce headcount, so they’ll subcontract the work to an outside company. It goes back and forth,” he said. “If they do have their own technicians, they’ll usually use them to do simple things like change out fan motors and lights, but if they run into bigger problems like compressor issues, they’ll usually call in an expert like us.”

Another trend affecting grocery stores — and refrigeration contractors — is the shrinking of the center store, said Ernest. He noted that more people are buying nonperishable items like paper plates and toiletries online, allowing stores to reconfigure the center store to allow for more fresh food, which will require additional refrigeration.

“While more people are using food delivery programs, there is also a growing trend to grab a prepared meal that can be microwaved at home,” he said. “The prepared meals section, along with more gourmet options for meats, cheeses, and vegetables, will require more custom and energy-efficient refrigeration systems, and it will take contractors like Climate Pros to install and maintain them. This is great news for us and our industry.”

In Growth Mode

Todd Ernest, CEO of Climate Pros, is very optimistic about 2020, noting that it should be another “fantastic” year. He believes sales will continue to grow — as will the size of his company, thanks to a vibrant acquisition program.

“There are so many small businesses out there owned by the baby-boomer generation that have no succession plan. We can give them a plan for their company, their people, and their legacy,” he said. “Our acquisition program successfully integrates and develops small businesses into what we do. We give their people the benefits and career paths that a small business just can’t provide, and through it all, we create and grow the family we call Climate Pros.”

This rapid expansion comes at a good time, as many big box retailers are looking to reduce the number of vendors they utilize. By increasing the size, expertise, and reach of his company, Ernest believes this will position Climate Pros to be the vendor of choice in many markets.

“We have designed our software, systems, and processes around the needs of our customers and our employees, which allows us to do more with less and serve our customers in a way that most others can’t,” he said. “This ability to be the sole or majority provider for many of our customers, combined with our acquisition growth program, is why we are poised for dramatic growth across the country.”

See more articles from this issue here!