Originally posted on 5/23/22, this article was named one of The ACHR NEWS' top 5 articles for 2022.

Big changes are coming to the HVAC industry, as of January 1, 2023, the Department of Energy’s (DOE’s) minimum energy efficiency requirements go into effect for all newly manufactured residential and commercial air conditioners and heat pumps. On the commercial side, this will mark the second efficiency increase in HVAC equipment in the last five years, while on the residential side, there will be separate efficiency standards and installation requirements for central air conditioners sold in the northern and southern parts of the U.S.

It is important for contractors to not only be aware of the changes taking place next year, but to take steps now to update inventory plans in order to be prepared for the new efficiency standards.

Changes

The new DOE standards will increase the minimum efficiency of residential equipment approximately 7%, or the equivalent of 1 SEER point and .6 HSPF for most equipment, said Jennifer Butsch, director of regulatory affairs at Emerson. What makes this transition a little more challenging, she said, is that OEM ratings will be based on a new test procedure and result in new metrics — SEER2, HSPF2, and EER2 (see sidebar).

Click map to enlarge

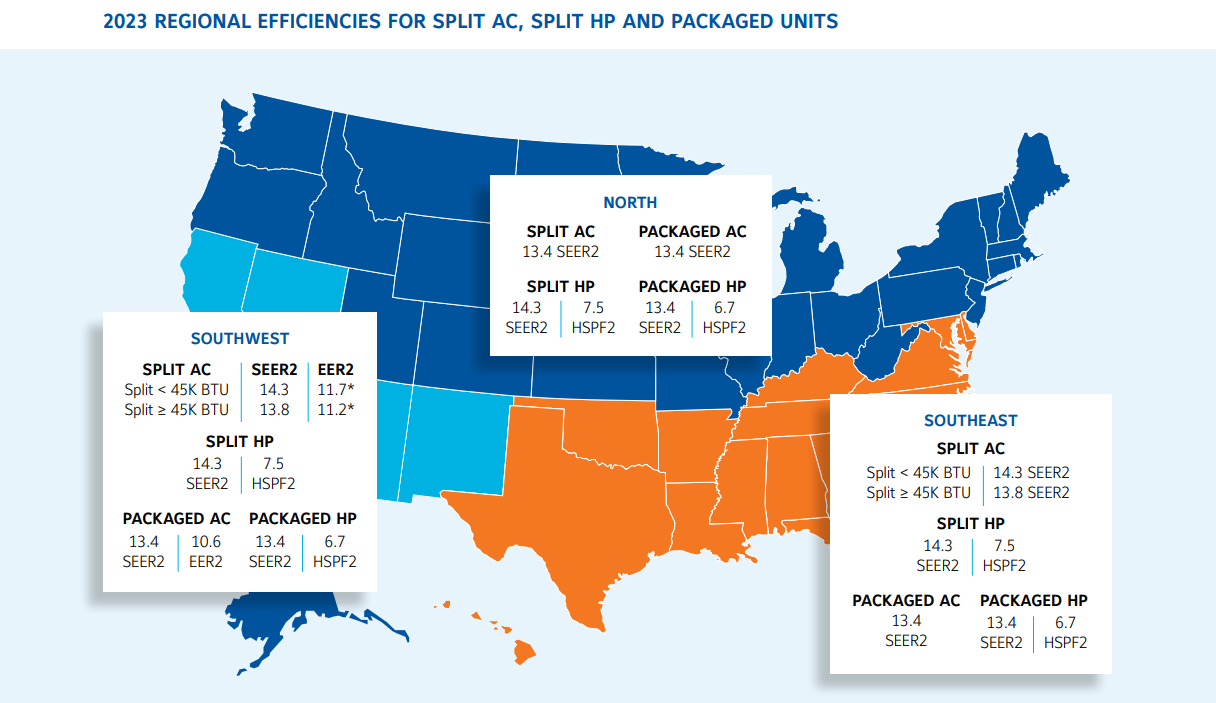

THREE REGIONS: Efficiency standards for single split central air conditioners are still divided into three regions: North, South, and Southwest, with higher SEER2 required for the Southern regions. (Courtesy of Johnson Controls)

“Efficiency standards for single split central air conditioners are still divided into three regions: North, South, and Southwest, with higher SEER2 required for the Southern regions (the same as it is today),” she said. “The new SEER2 minimum will be 13.4 in the North [equivalent to 14 SEER] and 14.3 [15 SEER] in the Southern regions. The new efficiency metrics will be reflected on the updated FTC energy guide labels.”

Another difference is that each of the three regions will have different date-of-installation and date-of-manufacture requirements based on product type, said Chris Forth, vice president of regulatory, codes and environmental affairs, ducted systems at Johnson Controls.

“In the North, sell through of residential air conditioning units built prior to January 1, 2023 is permitted on or after January 1, 2023, but newly manufactured SEER2, EER2 products must meet the 2023 minimum requirements in addition to being tested to a new DOE test procedure,” he said. “Air conditioners in the Southeast and Southwest are date-of-installation products and must be completely installed no later than December 31, 2022; therefore, sell through of air conditioners is not permitted unless their EnergyGuide labels meet the new 2023 SEER/EER minimums.”

The ratings published on a unit’s EnergyGuide label will determine whether or not an air conditioning unit for the Southeast or Southwest region can be installed on or after January 1, 2023, added Forth. The EnergyGuide labels must be at least 15 SEER (for products < 45,000 Btuh or 14.5 SEER for products ≥ 45,000 Btuh) in order to meet the new 2023 SEER minimums. Products in the Southwest must also meet the 2023 EER requirements.

“It’s important to note that the DOE considers heat pumps of all types as a national standard and as thus they are not subject to regional efficiency standards with one exception,” said Forth. “The exception is for single package heat pumps in the Southwest, which requires units also meet a minimum EER.”

On the commercial side, DOE increased the efficiency of air conditioning systems in two phases. The first phase occurred in 2018 and consisted of a 13% increase in minimum efficiency, while the second phase will take place in 2023 and require an additional 15% increase in part-load (IEER) efficiency.

The commercial HVAC market does not have regional standards, and DOE compliance is based on the ship date, said Henry Ernst, regulations and industry organizations manager at Daikin Applied. He noted that contractors should be aware that after December 31, 2022, the efficiency changes for all commercial air-cooled unitary products will fall into three different categories based on the capacity of the equipment, measured in MBH (thousand British thermal units per hour):

- 0-66 MBH three-phase products: ASHRAE 90.1-2019 and any equivalent state or local code will require new SEER2 and HSPF2 minimum efficiencies that are more stringent than today’s requirements. Canada has said they will require these minimums sometime in 2023, but this is not final.

- 67-760 MBH: ASHRAE 90.1 and any equivalent state or local code will require new IEER minimum efficiencies that are more stringent than today’s requirements. In addition, the DOE requires manufacturers to comply with these minimums on any unit shipped in the U.S. after Dec. 31, 2024.

- 760 MBH and greater: ASHRAE 90.1 and any equivalent state or local code will require new IEER minimum efficiencies that are more stringent than today’s requirements.

“It is also important to note that, per ASHRAE 90.1 and the DOE, the input capacity for furnace efficiencies >225 MBH will simultaneously increase after December 31, 2024,” said Ernst.

2023 - Appendix M1

| All | North | South | Southwest | ||

| Type | HSPF2 (HSPF) |

SEER2 (SEER) |

SEER2 (SEER) |

SEER2 (SEER) |

EER2 (EER) |

| 13.4 (14) | 14.3 (15) | 14.3 (15) | 11.7 (12.2)/ 9.8* (10.2) |

||

|

NEW

|

13.4 (14) | 13.8 (14.5) | 13.8 (14.5) | 11.2 (11.7)/ 9.8* (10.2) |

|

| Heat Pump | 7.5 (8.8) | 14.3 (15) | |||

| Packaged Units | 6.7 (8.0) | 13.4 (14) | 10.6 (11) | ||

*9.8 EER2 limit for equipment ≥ 15.2 SEER2

NEW MINIMUMS: The new DOE standards will increase the minimum efficiency of residential equipment approximately 7%, or the equivalent of 1 SEER point for most equipment. (Courtesy of Emerson)

Inventory Issues

For contractors installing residential products, the most important steps they can take now are to understand which region they’re located in, the types of products they install, and how the requirements for those products differ for their region, said Forth.

“The region determines efficiency requirements and whether product compliance is based on date of installation or date of manufacture,” he said. “It’s critical that contractors have a solid phase-in/phase-out plan, so they can take the appropriate steps to ensure they aren’t left with stranded residential air conditioner inventory that can’t be installed after January 1, 2023.”

Forth added that contractors also need to understand residential system matches (old to new and vice-vera) and be mindful about when they place their last-call orders and the date they are likely to receive those orders. This is especially important for air conditioning products that will be installed in the Southeast or Southwest, which must be installed no later than December 31, 2022.

Butsch agreed that inventory planning will be very important, especially in the Southern regions, because starting January 1, 2023, only single split central air conditioners that meet the amended regional standards (SEER2, EER2), as applicable, may be installed in the SE or SW region. She said contractors/distributors in these regions should plan to deplete any existing inventory that does not meet the new standard prior to January 1, 2023.

“In the North, systems manufactured prior to January 1, 2023 are allowed to be sold until inventory is depleted,” she said. “Unsold inventory from the south can also be transitioned to the North so as not to be stranded.”

As with previous standards, penalties will likely be implemented for installations that are non-compliant with the 2023 regional standards, said Butsch.

“Penalties for noncompliance may include out-of-pocket equipment replacement or heavy fines for those caught selling or installing non-compliant equipment,” she said. “To protect themselves and their businesses, contractors should keep detailed records of information pertinent to sales and models of equipment being installed.”

Even though according to DOE, commercial equipment built prior to December 31, 2022 can be sold and installed after that date, contractors should determine what compliance dates are applicable in their region, as it will vary based on local codes, said Ernst. Some of these products will have no compliance requirements in early 2023 because local codes have not been updated.

“Contractors should also take a different approach to ordering, inventory, etc., because ASHRAE 90.1 may be enforced based on the building permit date,” he said. “Everyone must look at their local codes, because contractors need to use up inventory of non-compliant units by this date. The DOE regulations for 66-760 MBH equipment and furnaces that go into effect at the start of 2023 will help, because manufacturers almost certainly will stop shipping non-compliant units.”

Director of regulatory affairs, Emerson

Communication is Key

One of the most important things contractors can do is to talk to customers about the upcoming changes so there are no surprises. Butsch said that all contractors should be prepared to explain the pending regulatory changes and how that impacts factors that consumers care about, such as first cost, expected energy usage given their climate zone, and potential utility savings over time.

“Contractors should also be prepared to explain the additional advantages in moving to higher efficiency, such as increased comfort and perhaps higher end features,” she said.

Ernst added that commercial customers want to understand the new energy efficiency requirements, and they will be looking to their contractors and other suppliers for advice.

“It would be helpful for contactors to remind their customers that the new, more efficient units are likely to be bigger and heavier so this could impact replacements,” he said. “In addition, compliance dates may need coordination, especially if determined by building permit dates.”

Forth advises residential contractors to talk to their customers about air conditioners that must be installed before January 1, 2023, are completely installed by the deadline. He said that while there is no official guidance from DOE as to what “installed” means, contractors should not assume that just because a job has been permitted and the equipment hasn’t been installed that they are in compliance.

Communication will be even more important when working through supply chain issues. Even though most OEMs are doing everything possible to ensure products are ready to go before the 2023 deadline, there may still be a few hiccups regarding equipment availability. To be ready for this possibility, Forth said contractors and distributors may want to consider taking the following actions:

- Convert to new SEER2, EER2 residential products as soon as available from manufacturers;

- For the “date of installation” residential air conditioning products in the Southeast and Southwest, convert some of those orders to mid-tier products with EnergyGuide Ratings > 15 SEER/14.5 SEER, as these products can be installed on or after January 1, 2023; and

- Also for “date of installation” air conditioning products in the Southeast and Southwest, convert some portion of orders to heat pumps, which are not at risk of being stranded. In certain climates, planning for dual fuel applications (a split heat pump paired with a gas furnace) may be a good opportunity to avoid stranded inventory and provide for fuel switching opportunities.

“I can’t stress this enough, communicate, communicate, communicate — OEMs to distributors, distributors to contractors, contractors to end users,” said Forth. “We’re all going to have to communicate like never before to ensure this transition occurs as smoothly as possible.”

Understanding the New Metrics

As part of the new minimum energy efficiency ratings for 2023, a revised testing procedure will determine energy efficiency ratings for residential and 3- to 5-ton light commercial, single-phase products. This new testing procedure will more accurately account for field conditions by increasing external static pressure (ESP) from 0.3 to 0.5. The new testing procedures will result in reduced (but more accurate) efficiency ratings under the current SEER, EER and HSPF ratings, so new metrics and nomenclature were developed.

These new metrics are SEER2, EER2, and HSPF2, and as noted, their ratings will be reduced compared to the 2023 SEER, EER, and HSPF minimum efficiency ratings for each region. For instance, the northern region’s current minimum requirement is 13 SEER, but in the future, the minimum requirement will be 14 SEER or 13.4 SEER2.

A 66% increase in external static pressure will result in increased blower motor watt usage, which will reduce energy efficiency ratings. The new DOE testing requirements will also result in changes to the airflow set point on indoor blowers, including fan coils and furnaces.

Every product tier will need to be retested, reoptimized, and relaunched in accordance with the new DOE test procedures.

Excerpted from Johnson Controls’ 2023 Regulatory Requirements Guidebook (PDF).