Home » economic reports

Articles Tagged with ''economic reports''

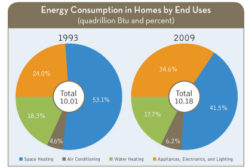

HVAC Research Reveals Customer Spending Motivations

American Home Comfort Study Sheds Light on Consumer Trends

Read More

JP Morgan Predicts Mixed Growth

Some distributors are already experiencing solid growth, while others are looking at minimal growth if any

June 20, 2013

Copyright ©2024. All Rights Reserved BNP Media.

Design, CMS, Hosting & Web Development :: ePublishing