Sound familiar? Nothing new here, right?

Even though the odds may seem to be against a commercial contractor, he/she can sell smart HVAC accessories, components, and equipment if the commercial contractor keeps the following in mind: Don’t sell products. Instead, sell the profits the products produce.

It’s that simple.

After all, the purpose of business is to create profits for its owners. Keep in mind that everything a business buys impacts profits at some level. Also, know that the capital follows the most profitable investments.

The best investment almost every commercial business could make today is to pay you, the commercial contractor, to lower their energy bills and reduce comfort-related problems. One exciting thing about selling smart HVAC products in the commercial arena is the amazing energy savings many provide. The more energy saved, the greater the return on investment (ROI) and the more likely the sale.

Click on the formula for an enlarged view.

KNOW ABOUT ROI

In the big picture, ROI is the most used management performance tool in business today. Did you know that 85 percent of companies use ROI before making major buying decisions? Unlike “profit,” which is an accounting term meaning different things to different people, everyone gets the same message with ROI.Here’s how it works. If a smart HVAC product that a commercial contractor sells costs $1,000 and reduces a commercial client’s electric bill $250 per year, the ROI is 25 percent. In four years, this product will pay for itself.

Click on the formula for an enlarged view.

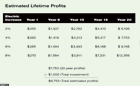

Chart A. (Click on the chart for an enlarged view.)

In the long run, many experts believe the cost of electricity will increase 50 percent to over 100 percent in the next 20 years. Let’s say the useful life of the smart HVAC product (in the example noted above) is 20 years. Add the fact that your commercial client has agreed that an electric rate increase averaging four percent per year seemed realistic to him/her. As you can see from Chart A, the commercial client can save $7,753 over the life of the product.

Click on the formula for an enlarged view.

TURN SOFT BENEFITS INTO HARD PROFITS

Another factor a commercial contractor should consider involves “hard” and “soft” benefits. These are easy to measure and readily accepted. For example, energy dollars saved going from an 8 EER to a 10 EER unit is a hard benefit. Meanwhile, example of soft benefits - which can be more important to the commercial client, but harder for the commercial contractor to quantify - include quality equipment, accurate installation, proper maintenance, increased productivity, improved production, and decreased downtime.Know that soft benefits become hard profits when the commercial buyer says, “That sounds reasonable.” The more you break it down to money, the more money you both make.

Let’s look at another example. Let’s say a commercial client’s 20-year-old commercial HVAC system failed three times last year. The client in question agrees it is “reasonable to expect” a new system should be much more reliable, which would reduce downtime.

The object here is to point out that reduced downtime turns into profit dollars. A commercial client should know that a day’s downtime could wipe out a month’s profits. The client also should know that each time the old unit fails, the building gets so hot that the occupants are unable to work for an entire day:

EVERY DECISION IS A FINANCIAL DECISION

Unlike residential buyers who make emotional decisions and then justify them with logic, commercial buyers make logical decisions and then justify them with numbers. No matter how much the person you’re working with loves your proposal, there is always someone in the accounting department with the ability to shoot it down. What’s really scary is you’ll probably never meet these potential “decision breakers.”Simply put, the bigger your project, the more financial scrutiny it receives. The task here is to give financial decision makers the tools they need to say, “Yes.”

The key is to design every proposal with the folks from the accounting department in mind. Speak their language. Break everything possible down into dollars. Document how the smart HVAC solutions you offer commercial customers provide more profits than anything else they can buy with the same money. In the unlikely event that someone else has a better ROI; it doesn’t matter if the financial decision makers don’t know it.

Remember, the No. 1 way to boost your profits is by documenting how much your clients can boost theirs.

Publication date:10/08/2007