As with many other products in the HVACR industry, federally mandated energy-efficiency requirements are influencing chiller product design, as are refrigerant regulations, the Internet of Things (IoT), the average customer’s growing desire to evaluate life cycle costs, and more. To meet these demands, HVAC chiller manufacturers are offering a range of products in multiple configurations that use new refrigerants, consume less energy, communicate more effectively, can be serviced more easily, and may be designed to fit a wide range of applications.

THE CHANGING CHILLER LANDSCAPE

Jeff Moe, product business leader – applied commercial HVAC, Trane, a brand of Ingersoll Rand, said Trane offers an extensive chiller product line that includes air-cooled, water-cooled, and compressor chillers, including the Trane Stealth™ air-cooled helical rotary chillers and the Trane Sintesis™ air-cooled chiller, which was introduced in 2015.

“Sintesis chillers are part of the Ingersoll Rand EcoWise™ portfolio of products designed to lower their environmental impact with next-generation, low-GWP [global warming potential] refrigerants and high-efficiency operation,” Moe said. “Sintesis chillers leverage variable-speed technology on both the compressor and condenser fans for high-efficiency operation — both part- and full-load units. The Trane Series S™ CenTraVac™ centrifugal chiller continues to be a popular choice with owners because of its efficiencies at full- and part-load [operation], its compact size, and its [low] sound levels.”

Tom McDermott, director of sales, ClimaCool Corp., said his company offers water- and air-cooled modular chillers for cooling, heat recovery, and simultaneous heating and cooling [SHC] applications. “Simultaneous heating and cooling products [have become more popular] because of their tremendous energy savings,” he said. “Chiller products have been influenced by more efficient heat exchangers and advancements in variable-speed scroll compressor technologies.”

Brian S. Smith, director of global marketing, chiller solutions and building efficiency, Johnson Controls Inc., said that, in addition to offering a wide range of chiller solutions — from small air-cooled scroll chillers to large 6,000-ton water-cooled centrifugal chillers, and from free-cooling air-cooled screw chillers to simultaneous heating and cooling centrifugal heat pumps — the company has also been expanding some product lines to include larger capacity chillers.

“Just recently we extended our York water-cooled magnetic-bearing centrifugal chiller, the YMC2, up to 1,000 ton, so the offering now includes 165-1,000 ton,” Smith said. “We have seen growth in customers’ interests for highly efficient chillers that require less maintenance, and the magnetic-bearing design and oil-free operation of the YMC2 chiller offers this.”

Chris Opie, marketing director for Carrier Commercial, pointed to Carrier’s wide range of both air- and water-cooled chillers that span 10-5,000 ton to satisfy many applications. “They are either manufactured or assembled in the LEED [Leadership in Energy and Environmental Design]-certified Charlotte, North Carolina, facility, which also received IndustryWeek’s Best Plants Award in 2010,” he said.

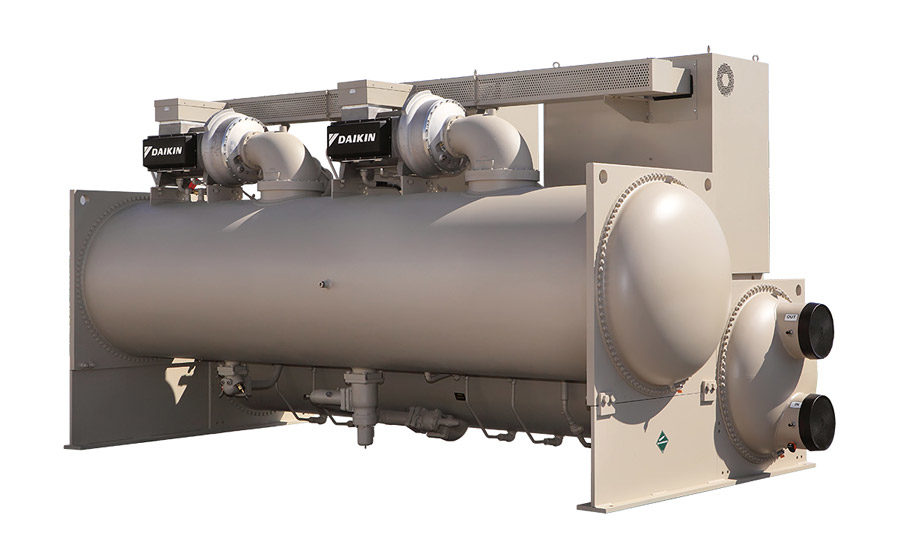

Daikin also offers air- and water-cooled chillers to meet its customers’ needs across the commercial market, said Bill Dietrich, product general manager, chillers, Daikin Applied.

“Energy efficiency, maintenance, sound, and water availability have been key market drivers in recent years, and we’re seeing them drive customers’ chiller choices,” Dietrich said. “Our magnetic-bearing Magnitude® centrifugal chillers have gained popularity in recent years due to their efficiency, sustainable oil-free operation, low sound levels, and low maintenance. The performance of our new-generation Trailblazer® and Pathfinder® air-cooled chillers are designed so you don’t have to sacrifice efficiency for maintenance or water-free operations. These chillers have become popular for sites with limited indoor space, no on-site service personnel, or areas with poor water quality or limited water availability.”

EFFICIENCY IMPROVEMENTS

Perhaps the biggest trend driving chiller product design is the push for increased energy efficiency, both from the federal government and end users.

“Compressor and heat exchanger technologies continue to evolve and improve,” Dietrich said. “Recent innovations — such as permanent magnet motors, magnetic bearings, and integral variable-speed drives — combined with improved compressor and heat exchanger technologies are driving chiller performance today. [Daikin Applied] continues to see reduced annual energy consumption, especially driven by improved performance at off-design conditions, which is where we focus most of our efforts.

“Packaged air conditioners and heat pumps serve more than 60 percent of the commercial building floor space in the U.S., contributing to about 230 trillion Btu of energy consumption annually,” he continued. “Therefore, even a small increase in operational efficiency of these units can lead to significant reductions in energy use and carbon emissions.”

Smith said Johnson Controls is seeing chiller customers invest in more efficient chillers to reduce their total cost of ownership and save energy costs during the life of their equipment.

“Over the past few years, we have been able to improve chiller efficiency through several mechanisms,” he said. “One of the biggest is in the technology we select for our chiller design. With the York magnetic bearing centrifugal chiller — the YMC2, for example — we utilize magnetic levitation in its driveline to spin without friction, reducing moving parts and offering more efficient operation.”

Moe also said there is a growing focus on total life cycle costs from customers.

“Increased attention is now being given to the demand [kW] charges, which often exceed 50 percent of the utility bill and are driven by full-load efficiency,” he said. “This shift has led to greater opportunities for owners to earn utility rebates on equipment with high full- and part-load efficiencies.”

Opie also said chiller efficiency has improved dramatically, especially at part-load operation. “[Carrier’s] customers realize chillers spend the vast majority of their time running at part load and/or part lift; for this reason, we have focused enhancements on this part of the operating envelope,” he said. “Customers have become more focused on energy efficiency and sustainability, and we don’t see this trend changing.”

THE IOT’S INFLUENCE ON SERVICEABILITY

The Internet of Things (IoT) is also influencing chiller serviceability and maintenance by providing easy, real-time access to significant amounts of data and sometimes even allowing remote monitoring and control of the chillers themselves.

“The ‘Internet of Things’ has provided a new level of insight into the overall operation of HVAC systems, which enables a greater level of efficiency and reliability,” Moe said. “Predictive analytics allow for abnormalities to be identified earlier, helping to mitigate issues before they become bigger problems. With Trane Intelligent Services, 24/7 system monitoring and response capabilities are possible. By continuously monitoring the chiller’s operating conditions and performance, Intelligent Services can quickly react to changes any time — day or night — addressing potential problems before they become more serious.”

“One offering we provide that has been influenced by the Internet of Things is Johnson Controls’ Smart Connected Chillers,” Smith said. “With the power of embedded connectivity, chiller data are sent 24/7 into Johnson Controls’ high-security cloud, where intelligent algorithms are used to diagnose the chiller’s real-time performance. Johnson Controls’ service experts analyze and decode chiller performance and provide suggestions on how to run customers’ systems more efficiently and prevent costly downtime.”

Improvements in chiller controls and communications have allowed for more remote diagnostics and proactive and preemptive troubleshooting, Dietrich said.

“If service technicians must go to the site, they are often better equipped to service the equipment right the first time,” he said. “Daikin’s Intelligent Equipment® is embedded with Intelligent Equipment’s energy sensors and advanced connectivity capabilities [that offer] equipment management, energy measurement, monitoring, control, analysis, and decision-making capabilities for the end user. And, of course, better decisions drive tenant comfort, energy efficiency, and our customers’ bottom lines. We’re excited to offer that return on investment to customers.”

For Carrier, remote connectivity and online diagnoses are now a requirement, Opie said. “Customers want the service support team to be aware of the status on their system in advance of the technician’s arrival,” he explained. “Troubleshooting a unit on-site is becoming obsolete.”

PREDICTING THE FUTURE

Industry leaders agree that trends in increased chiller efficiency, connectivity, and serviceability will only continue into the foreseeable future.

“Chillers used to be large cooling-only products,” McDermott said. “I see the market heading toward equipment that can provide both cooling and heating needs. There is also a big push for inherent redundancy in products.”

“I think we will continue to see building loads drop as the movement to net-zero continues, and the trend toward air-cooled packaged equipment will also continue to grow,” Dietrich said. “I anticipate building owners will request more efficiency in the way they use the machines in actual building operation, with less focus on load performance. This means chillers must have more variable-speed options for better performance in a variety of conditions.”

Refrigerants will also soon be in the spotlight, Smith said. “As the chiller industry begins the next refrigerant transition, there will be a movement away from HFC [hydrofluorocarbon] refrigerants in new equipment to lower-GWP refrigerants. Unlike past refrigerant transitions, this transition is more complex with many more alternatives, and, unfortunately, some of those alternatives are less efficient and others are flammable, while [most] all of them are more costly. In order to ensure this refrigerant transition produces the intended objective of a smaller total impact on the environment, chiller manufacturers will need to optimize designs for increased efficiency with less efficient refrigerants. The industry will also need to acknowledge the potential use of flammable refrigerants by addressing the safe implementation of these refrigerants in applications where operators, technicians, owners, etc., may not have the facilities, tools, knowledge, training, or experience in dealing with flammable refrigerants today.”

Moe also said refrigerants will exert an even greater influence on the market in coming years. “Some next-generation refrigerants provide customers with options that [have a] significantly lower environmental impact while maintaining similar performance,” he said. “Understanding customers’ needs and helping meet their business objectives are key for chiller design engineers at Trane.”

Publication date: 5/9/2016

Want more HVAC industry news and information? Join The NEWS on Facebook, Twitter, and LinkedIn today!