Demand for air source heat pumps is forecast to increase 2.5 percent per year through 2021 to $2.1 billion. Air source heat pumps comprise a significant amount of total heat pump demand, largely due to the easier installation requirements and lower initial costs than geothermal heat pumps. Air source heat pumps also compete more directly with other HVAC equipment and are a viable heating and cooling option in most buildings. Moreover, in many instances, air source heat pumps are a lower cost option than a separately purchased unitary air conditioner and warm air furnace. These and other trends are presented in Heat Pump Market in the U.S., a new study from The Freedonia Group, a Cleveland-based industry research firm.

Among air source heat pump types, air-to-air heat pumps will continue to account for nearly all product demand due to:

- Air-to-air heat pumps are well suited for installation in most buildings in the U.S., as forced air heating and cooling dominates.

- Air-to-water heat pumps require hydronic systems to transfer heat throughout a building, a type of heating system that historically had not been used in the U.S.

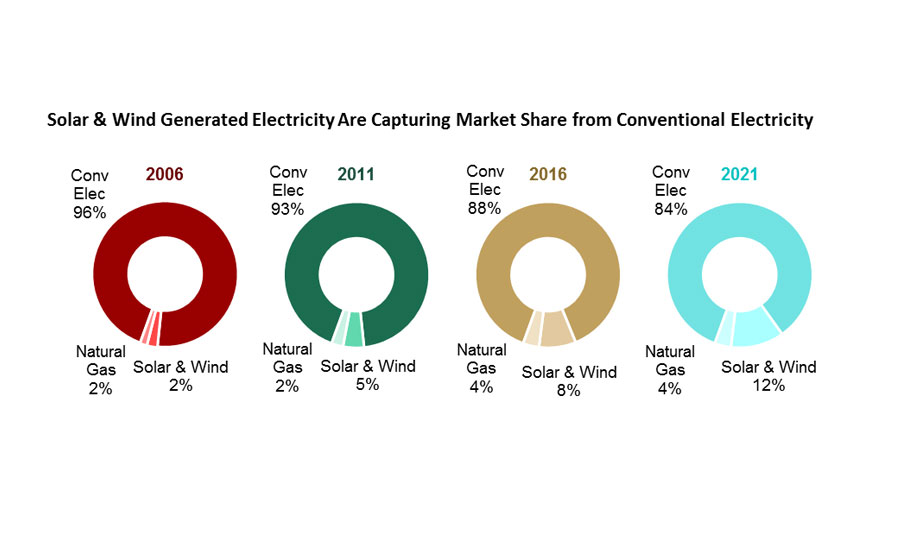

Demand for heat pumps powered by conventional electricity is projected to increase 2.3 percent per year through 2021 to $1.8 billion, remaining the dominant energy source with 86 percent of all heat pump sales. Nearly all buildings in the U.S. are connected to the electric grid, making this energy source the most commonly used for cooling equipment. However, growth will lag that for products using electricity generated from solar and wind power, spurred by environmental concerns over utility generated electricity, as well as a rising interest among building owners to generate their own electricity through sustainable means.

For more information, visit www.freedoniagroup.com.

Publication date: 3/29/2017

Want more HVAC industry news and information? Join The NEWS on Facebook, Twitter, and LinkedIn today!