Jobber, provider of home service management software, has released its Home Service Economic Report: 2021 Mid-Year Review, which features insights and proprietary data aggregated from over 100,000 home service providers, including HVAC technicians, plumbers, electricians, and construction contractors. The report, dated August 2021, shows that the contracting segment has recovered well from the pandemic and the economic downturn it induced. Consumer spending on home services — including HVAC — recovered faster than all other categories and has exceeded pre-pandemic levels from June 2020 onwards.

Click each chart to enlarge

(Courtesy of Jobber)

(Courtesy of Jobber)

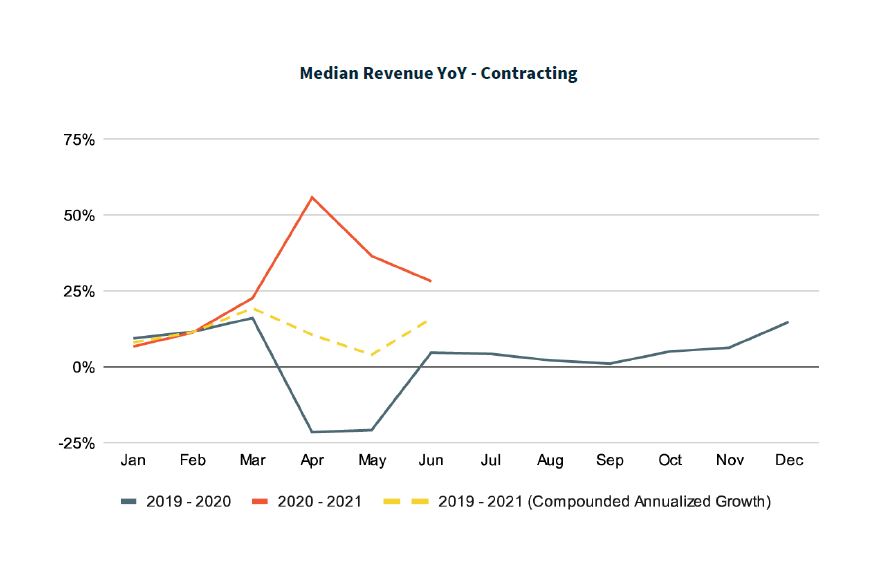

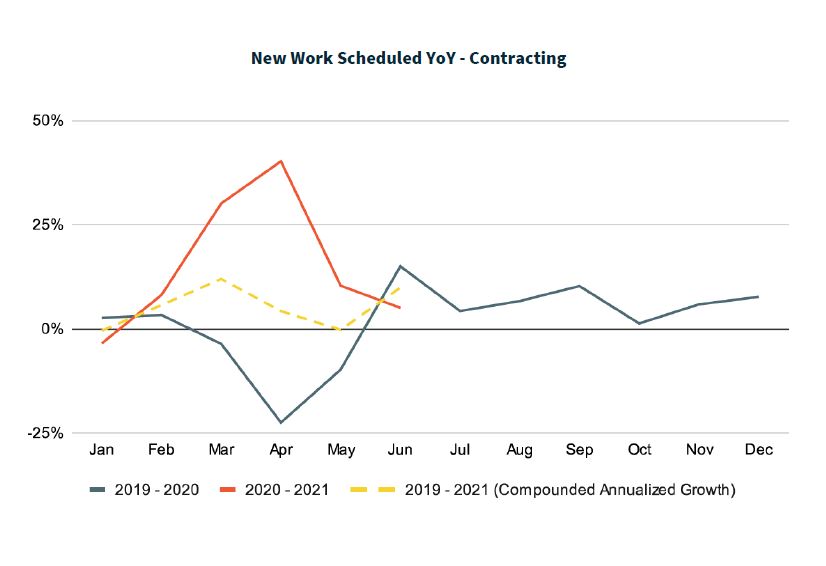

“Both new work scheduled and median revenue are seeing positive growth throughout 2021, a trend we believe will continue as we enter the second half of 2021,” said Sam Pillar, CEO and co-founder at Jobber. “New work being scheduled is an early indicator of the health of home service businesses and a proxy for consumer demand. The revenue growth is especially impressive, as it’s now four quarters of impressive growth stringed together.”

To analyze the growth in 2021 without seeing unnaturally high numbers from March-June 2021 due to the first wave of the pandemic last year, the report measured and visualized 2021 monthly data as compounded growth from two years prior in 2019. This way of looking at the 2021 data was used throughout the report to normalize for unnatural year-over-year swings.

(Courtesy of Jobber)

“This shows that growth has slowed down slightly compared to the very high rate in Q4 2020, but still remains positive,” the report stated. “After experiencing a decline in April 2020, home service rebounded to pre-pandemic levels by June 2020 and has been steadily on the upward trajectory ever since. We expect positive growth to continue throughout the second half of the year.”

FIVE TAKEAWAYS

Following are five highlights from the report that HVAC contractors should know.

1. Americans are still really interested in home renovation.

(Courtesy of Jobber)

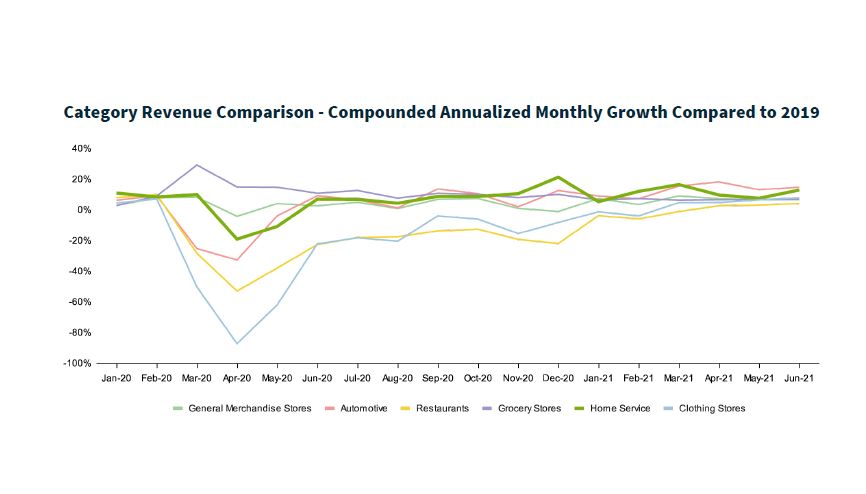

The home remodeling market is booming and is stronger than pre-pandemic levels. According to the Leading Indicator of Remodeling Activity (LIRA) released by the Joint Center for Housing Studies of Harvard University, annual growth in home renovation and repair expenditure reached 6.1% year-over-year growth in Q2 2021 and is expected to grow by 7.6% by the end of 2021.

(Courtesy of Jobber)

The data shows healthy growth in new permits issued throughout the second half of 2020 and into 2021.

“The trend is shifting from DIY home improvements to professional renovations, as more homeowners feel comfortable inviting contractors back into their homes,” the Jobber report said.

2. U.S. home sales remain high.

(Courtesy of Jobber)

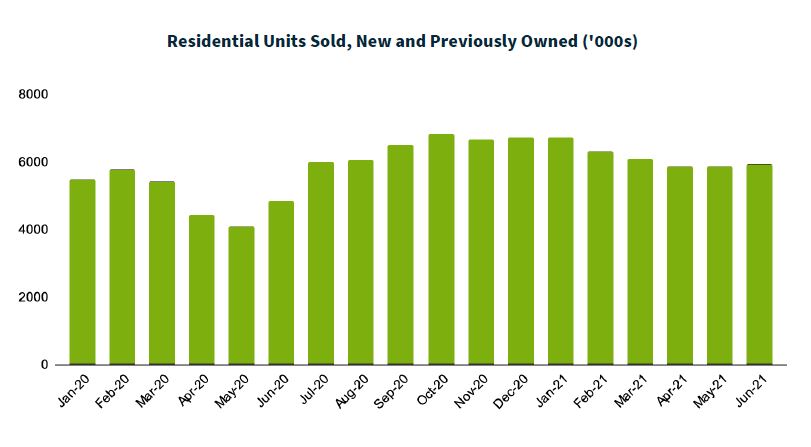

Sales of new and existing homes reached record levels in the second half of 2020 and into Q1 of 2021.

“The health of the home service category is naturally connected with the residential housing market as the rise in housing sales translates into increasing demand for home services,” stated the report. “Although experiencing a decline in April-June 2020 when the COVID-19 pandemic hit, the sale of new and existing homes recovered very quickly, reaching record levels in the second half of 2020 and into Q1 of 2021. In Q2, sales dropped slightly, but still remained very healthy. In addition to the growth in new and previously owned units sold, the data shows healthy growth in units built and under construction.”

3. New construction is gaining steam again.

(Courtesy of Jobber)

The report showed significant growth in new building permits issued, which in the last quarter have surpassed pre-pandemic levels.

4. The demand for skilled trade jobs is far outpacing the supply of qualified workers.

In this past quarter, the U.S. unemployment rate has improved to greater than 6% in May and June 2021.

The recovery rate for unemployment in home services is better than other categories. While millions of Americans are looking for work, PeopleReady found that the demand for skilled trade jobs is far outpacing the supply of qualified workers to fill them. Data sourced from the U.S. Bureau of Labor Statistics illustrates the comparative impact the shortage of skilled workers has had on various industries, including construction.

(Courtesy of Jobber)

“The ratio of hires to job openings has decreased significantly, suggesting that there is a desire to hire workers in many major industries, but a lot of positions are left unfilled,” the Jobber report stated. And as most contractors can attest, they are getting more job requests than they’re able to fulfill with current staffing.

“We know from conversations with our customers that hiring workers is incredibly challenging, particularly now,” said Pillar. “Our data also reinforces that businesses are struggling to hire workers in many home service industries to meet customer demand. If you've ever considered pursuing a career in home services, now is the time.”

Translation: If there was ever a time to up the game with recruiting, it is now.

“The employment recovery in Home Service, albeit slow, is better than most other categories. As consumer demand for Home Service grows, the shortage of skilled workers will continue to impact the ability for businesses to meet this demand,” the Jobber report predicted. “This, in addition to higher material costs, are challenges that will likely continue for the rest of the year.”

5. Increased demand plus a broken supply chain means longer waits for construction projects.

(Courtesy of Jobber)

A spike in home improvement projects, coupled with global supply chain issues due to the pandemic, have combined to cause severe backlog challenges for contractors. Average wait time for the overall construction industry to start a project was up by almost four weeks in Q2 2021 compared with the same period last year.

(Courtesy of Jobber)

In addition to labor shortages, producer price index (PPI) for net input to construction industries (goods) have soared as a result of scarcity in the face of increased demand, the Jobber report stated.

“The PPI for Lumber and Wood soared 50% by June 2021 compared to January 2020, while PPI for Steel Mill Products increased by 82% during the same period. Diesel, which experienced a 50% decline compared to Jan 2020 in May 2020, observed a complete shift and increased by 46% compared to Jan 2020.”

The supply and demand issue extends to contractors, who are getting more job requests than they’re able to fulfill.

(Courtesy of Jobber)

The impact of higher material costs is also reflected in the invoice size of construction and contracting projects. The median invoice size grew by 14% in Q2 2021 compared to the pre-pandemic levels of Q1 2020.

“Altogether, these dynamics have led to mixed results for the construction industry,” summed up the report. “After healthy growth in new work scheduled throughout the second half of 2020, new work growth in 2021 has been quite volatile. Similarly on the revenue growth side, last quarter saw quite a slowdown in CAG since 2019 after a healthy Q4 2020 and Q1 2021.”

Looking Ahead

“The essential nature of home service has allowed this category to persevere during times of economic uncertainty,” the report concluded. “In some cases, the category is even benefitting from new trends that have emerged, particularly in real estate and construction. Bolstered by the sale of new and existing homes and growth in home renovations, home service will likely continue seeing steady growth as we enter the second half of 2021.

“Unfortunately, the COVID challenge still persists, with a rise in delta variant cases and a general rise in cases overall,” it continued. “Although vaccinations that have already been distributed are expected to help with this new wave, the impact on society as well as the economy is hard to predict. That said, many home service businesses have been able to navigate through the previous waves and will be able to draw on that experience moving forward.”