With the heat pump market experiencing a surge in demand, fueled by incentives and an increasing emphasis being placed on decarbonization, HVAC contractors need to study up on all the behind-the-scenes complexities attached to some of the incentives.

From eligibility requirements to variation in programs across states, staying up-to-date with the latest developments is crucial if these incentives are actually going to be delivered to the customer as promised.

Jennifer Butsch, director of regulatory affairs, has been with Copeland for the last eight years, and part of her duties include collaborating with agencies, OEMs, and various stakeholders. Sitting in on a webinar hosted by ACCA earlier this month, she cleared up some of the haziness on why certain heat pumps will qualify for certain incentives.

There are a lot of trends working in conjunction to drive heat pumps, but if a unit, or even the contractor installing it, doesn’t meet certain specifications, they may not be eligible for all of the money being thrown at this movement.

Square One: Where Requirements are Born

When speaking about heat pumps, there are a lot of different metrics used to measure efficiency, so it’s good to know who is setting these levels and why they matter.

The minimum levels needed are set by the feds at the Department of Energy and, as Butsch explains, heat pumps need to meet these standards in order to even be placed on the market.

“Heat pumps are a nationally regulated product, so only one set of efficiency levels to be aware of, which is nice,” she said.

These metrics are revised approximately every six years, at which time they are likely to see a bump in efficiency requirements.

Next are the refrigerants, which are regulated by another federal agency: the EPA. Currently, everyone is preparing for the transition to A2Ls, R454B, and R-32 on the residential side.

A step beyond that is the “mid-tier” level, which largely comes from two different organizations: Energy Star and the Consortium for Energy Efficiency (CEE).

Butsch explained Energy Star represents consumers and tries to identify higher-efficiency products that are affordable but would save consumers energy. The CEE represents a consortium of utilities looking to incentivize and work collaboratively to accelerate the adoption of energy efficiency products, largely through incentives.

The last group setting requirements are national, state, and local governments.

“They may have additional requirements on different heat pump levels, different metrics where you may qualify for different incentives, or utilities themselves may set different rebate levels based on efficiency and hitting that efficiency,” Butsch said. “So all things to be aware of as we look across this heat pump market space.”

Classifying the Requirements

To simplify a complex equation, Butsch broke it down into four key buckets in which these different requirements are classified for implementation:

-

Decarbonization and electrification — essentially an effort to move away from fossil fuel sources to clean energy and electricity, and is largely driven by the States, although the DOE and Energy Star do have a hand in it, to a lesser extent.

“We've recently seen Energy Star no longer recognize furnaces. For example, they're going to start to phase out central air conditioning, all in favor of heat pumps,” Butsch said. “So that's something to be aware of.” - Energy efficiency — really just efforts to reduce the energy being used to begin with, through the purchase of higher-efficiency products. Largely driven by DOE and CEE/Energy Star.

- Low-GWP refrigerants — efforts to reduce greenhouse emissions, and driven by the EPA and states.

-

Material/other — a somewhat new effort, largely driven by states, but essentially rules regarding packaging and plastics requirements. Part of this is the phaseout of per- and poly-fluoroalkyl substances, which Butsch said is going to have a huge impact.

“It's largely going to hit us probably about a decade from now, but something that manufacturers are keenly aware of at the moment,” she said. “There's also a lot of efforts to restrict single-use pack plastics, including packaging and other plastics within the products, so you may see some redesigns driven by this.”

Classifying the Rebates and Incentives

The money a customer could potentially see back following a purchase can come from three main pools: OEM promotions, rebates, or tax credits.

For OEMs, these are the “instant savings,” or what a customer may see right at the point of purchase. Here, they might get some sort of discount, or perhaps even be offered some sort of bundled incentive.

“They either give you a certain dollar amount off if you buy a certain efficiency heat pump, or they may throw in another appliance for free — sometimes humidification or dehumidification,” she said.

As for rebates, these are generally a direct payout or credit. For example, a utility company may offer a $200 credit for installing a high-efficiency heat pump.

“Rebates largely come through utilities, but there are also federal rebates available right now,” Butsch said.

Last, but not least, are tax credits. The important thing for customers to understand here is that these only subtract from taxes owed, so a tax burden is required.

But in order for a customer to get any sort of financial incentive back from any of these pools, they must meet certain efficiency requirements.

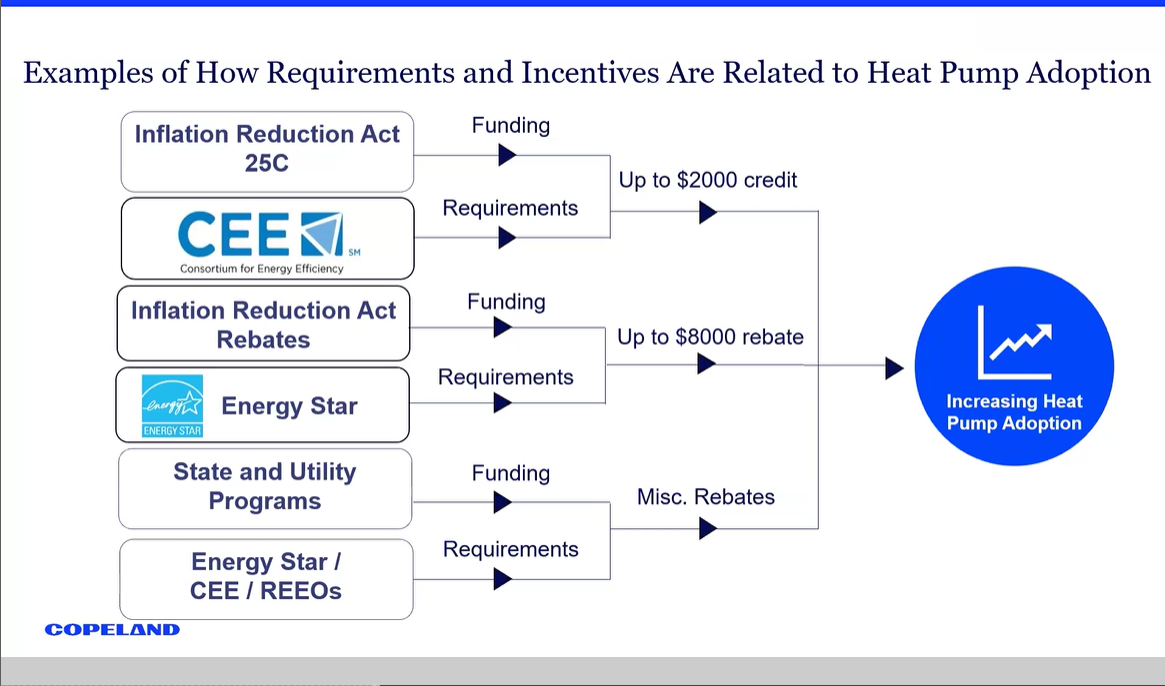

Click chart to enlarge

INTRICATE WEB: This chart from Copeland shows the different requirements that need to be met before reaching the ultimate end goal of heat pump adoption. (Courtesy of Copeland)

Tying it All Together

Going into a little more detail, Butsch gave some examples of how an incentive option would play out.

For the Inflation Reduction Act, specifically 25C, a buyer could get up to $2,000 (30% of the total cost, up to $2,000, to be exact), but that’s dependent on the heat pump’s CEE efficiency level.

“But, again, you have to have a tax liability,” Butsch added.

For IRA-specified rebates, there are two options — a high-efficiency appliances and HOMES, which are based on some modeling; those are actually dependent on the Energy Star tiers.

“While (Energy Star and CEE) tend to try to align, they're not exactly the same, so you need to be aware of what those different rebates levels are through Energy Star,” Butsch said.

Under these rebates, there is up to $8,000 as a point-of-sale rebate program on the line.

“It is targeted towards low- and moderate-income families, and it is being run actually by the state energy offices,” Butsch said. “So although the funding is coming from that federal source, the program requirements are coming at the state level, and so this is going to present a little bit of fragmentation.”

Then there are the state-level and utility programs, which may rely on Energy Star, CEE, or regional energy efficiency organizations like NEEP (Northeast Energy Efficiency Partnerships) or NEEA (Northwest Energy Efficiency Alliance).

“But they also may set their own and kind of tailor their own efficiency levels for whatever their program it is that they're trying to support,” Butsch said. “And so those come out as miscellaneous rebates that you'll need to monitor.”

“So it's a little confusing, but just make sure that you're referencing the right program for the incentive that you're presenting to the end user. And again, the rebates have two different rebate structures. One's that home electrification and appliance rebate, and the other is that whole-home energy program.”

Given many of the rebates and incentives are going to be regionally dependent on states and utilities, Butsch suggests using these two online resources to keep up-to-date with the latest information: www.dsireusa.org and www.energy.gov/save/rebates

Getting More Systems Online

The purpose of all of these incentives is to essentially get rid of older, less efficient systems and replace them with heat pumps.

In the Northeast, their energy efficiency programs helped jump-start the adoption of cold climate heat pumps, largely replacing, or supplementing, boiler operation.

“Largely, these cold-climate heat pumps are designed to replace fossil fuel furnaces or supplement them, meaning in the case of dual fuel, you take away many of the operating hours and actually use the heat pump for those operating hours, only relying on the furnace for those coldest days where you're trying to really reduce the reliance on strip heat, which is really inefficient electric,” she said. “So as we think of electrifying end uses and the additional burden on the grid, dual fuel and some regions is actually a very, very good solution.”

As for when these programs will be available in certain areas, that again depends on the state’s action in applying for these funds. There are currently six states (Arizona, New Mexico, Wisconsin, New York Rhode Island, and Maine) as of Sept. 27 with approved applications, seven states who have applications approved but don’t have funds available yet (Washington, California, Colorado, Minnesota, Michigan, Indiana, New Hampshire, and Washington, D.C.,) with the rest of the states and U.S. territories falling into either the “preparing application” or “application submitted” statuses.

South Dakota, however, has declined to participate.

“I think initially people thought these dollars might roll out more quickly, but it is a process. It takes time, and because it's managed by the state energy offices, each program is going to be slightly different.”

However, each state has the flexibility to roll it out as they see fit within these guidelines or that were released by the Department of Energy. So again, going to that DOE website is going to be the best bet, because this is going to be a fragmented rollout.

Each state could also have different requirements for what contractors are eligible to work within these programs.

“Again, there could be different layers involved in obtaining these rebate dollars for that end user,” Butsch said.