In their May 31 Core Report, Majestic Steel USA analysts shared insights on the cost, supply, demand and economy of steel markets.

Iron ore

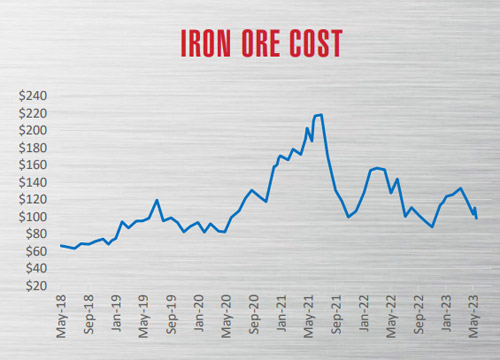

Iron ore prices are following a sharp downward trend for the seventh consecutive week, with prices ending at $98.10/mt on May 26, down about $12 from a week ago. While this is the lowest price level since Nov. 2022, Chinese steel demand is expected to pick up during the summer, as peak spring construction fell below expectations.

Images courtesy of Majestic Steel USA

Images courtesy of Majestic Steel USAWeekly zinc pricing

Zinc is likewise falling rapidly, with prices ending the week at $2,319/mt, down from $2,490/mt during the week of May 19. It is at its lowest level since July 2020. The restart of zinc mining and smelting has increased to a surplus in China, and while Shanhai's warehouse inventory fell slightly, global inventories rose to 63,450 metric tons from 47,525 the week prior.

Coking coal

While coking coal peaked in Feb. to nearly half of the high from March 2022, it's fallen by 43% since. It ended last week at $222/mt, down slightly from $224.50 the week of May 19. Analysts at Majestic Steel note spot buyers in India have fulfilled their requirements for summer production and demand in China is subdued.

Steel production

Domestic steel production was up again last week in four of five regions, following a nationwide trend for the last seven of eight weeks. Southern states lead the pack with production spiking to 728k tons, 2k higher than the week ending May 19.

Throughout the month of April, global steel production picked up — furthering a trend for a third consecutive month. April featured the highest daily production rate since May 2022, despite Chinese production coming in flat, owing in part to a 2.2% climb in north America in March.

New home sales

The median sales price for new homes slipped to $420,800, the lowest level since Dec. 2021. Inventory likewise slipped for the 6th consecutive month, with 422,000 unsold new units still on the market.