In their June 30 Core Report, Majestic Steel USA analysts shared insights on the cost, supply, demand and economy of steel markets.

Iron ore

Iron ore is now up four out of the last five weeks, with spot iron ore pricing ending the week of June 30 at $113.95/mt — the highest price point for spot iron ore since mid-April. Prices are riding high because of the economic stimulus occurring in East Asia.

Majestic Steel analysts say Chinese stimulus will continue to boost demand for steel. One of the world's largest steel producers, third to China and India respectively, Japan, is likewise bucking the global trend for monetary policy tightening with stimulus.

Images courtesy of Majestic Steel USA

Images courtesy of Majestic Steel USAZinc and coking coal pricing

Zinc prices came in flat this week at $2,362/mt after having climbed the three weeks prior. Warehouse inventories rose now for the fifth out of the last six weeks.

"Weak demand from the global construction industry has pushed zinc prices to levels which leave some miners with little or no profit," the analysts write. "A prolonged period below $2,400 a metric ton is likely to trigger output cuts once again."

Coking coal is up 6% over the last month, however pricing is still down 35% from the recent peak in February. India continues to play a leading role in demand for coking coal, as they have been steadily restocking over the last several months.

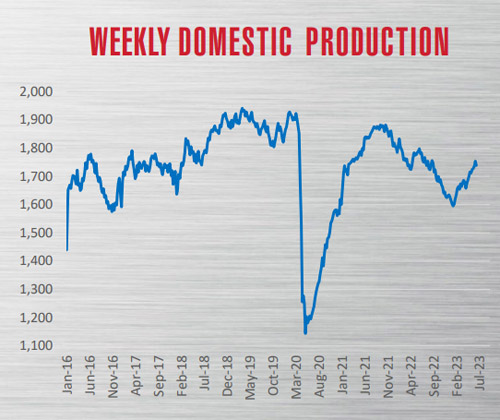

Steel production

Domestic raw steel production continued to come in high, with U.S. mills producing an estimated 1,758k tons at a 78% utilization rate last week. Production increased in four of the five regions, with the largest increase (in tons) coming from the Great Lakes region. However production year-to-date is down 4.8% compared to the same timeframe last year. Conversely, year-to-date carbon flat rolled imports are still down 36.1% compared to the same timeframe last year.

Gross domestic product

The third and final revision to Q1 '23 gross domestic product increased at an annual rate of 2%, reflecting upward revisions to consumer spending and exports. This is below the 2.6% growth rate in Q4 '22, as the upward revisions were partly offset by downward revisions to nonresidential and federal spending.