One of the key entries in the HARDI Summit’s parade of data is the annual contractor survey. TJ O’Connor, president of Farmington Consulting Group, walked attendees through this year’s national survey of 411 contractors spanning the range of company sizes and geographic regions.

Product availability and a somewhat better year than had been feared were common threads running through the data. However, priorities and trends also differed depending on the size of the contractor and occasionally its location.

Distributor Appeal

What is most important to contractors when selecting a distributor? In a year when simple availability became a serious issue, it is no surprise that product availability topped the list of replies.

Pricing came in second, with large contractors putting a greater emphasis on that than other distributor attributes. Timely and accurate delivery service ranked third, ahead of equipment manufacturer brands represented.

The remaining four ran local technical support in fifth, followed by outside salesperson presence/relationship in sixth, then warranty and counter/will call service rounding out the top eight.

It’s worth looking that far down the rankings because while counter service only finished eighth, small contractors (under $1 million annually) value it enough to rank it third. Somewhat unusually, so did contractors in the Southwest, where it also ranked third.

Equipment and Parts

Do contractors value different things when buying equipment versus buying parts? Yes.

When buying equipment, inventory is the unsurprising top priority. Brand is second, followed by pricing.

When the need is parts, inventory is still king but counter/will call service leaps up to second, with pricing staying third.

However, pricing becomes the most important attribute when contractors need refrigeration-related materials, with counter and will call service second-most on their minds. Plumbing and hydronics is the only other category where these contractors considered pricing the most important factor.

Controls generate yet another combination of interests, with inventory first, followed by pricing and counter service.

Value-Added Valuations

When it comes to the extras that can attract a customer, nothing topped 24-hour emergency service, whether that meant someone to call or the ability to make a late-night run to pick up a part.

The ability to track a delivery and access to marketing services took second and third, respectively, although smaller contractors find the marketing resources to be especially important.

The top eight value-added services in the eyes of contractors runs:

- 24-hour emergency service

- Delivery tracking system

- Marketing service for contractors

- VMI / consignment / auto-stock replenish

- Engineered drawings / layouts

- Mobile app

- Product locker pickups / overnight delivery to customer’s lockbox

- Jobsite storage

All in all, a fairly even spread between newer technological conveniences, time-saving transfer methods, and traditional inventory and marketing options.

Click graphic to enlarge

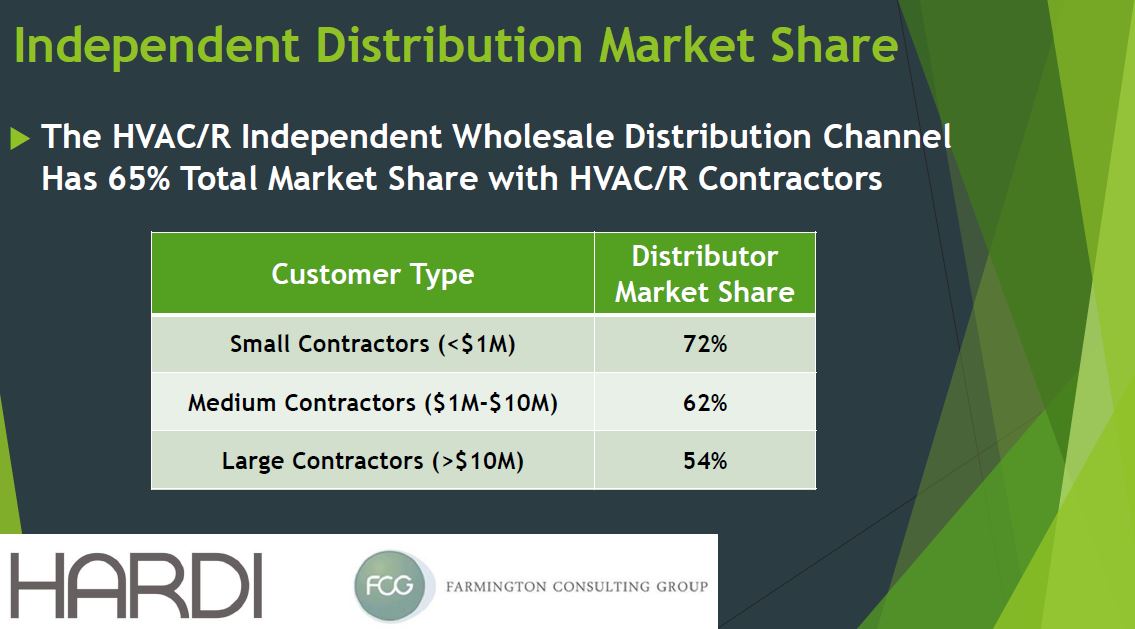

SMALL BUT STRONG: HVAC distributors can’t afford to overlook the little guy. Small contractors with $1 million or less in annual revenue compose the category most loyal category to the traditional three-step model.

COVID: The Disappointments

Last year threw a wrench into standard operating procedure for every business. Keeping in mind the variety of extenuating circumstances at every step in the supply chain, lack of product availability was the runaway top complaint about distributor service during the pandemic.

Lack of outside sales contact also came up frequently, enough to place second ahead of distributors who closed doors entirely to their customer and, in fourth place, understaffing.

What effect did the inventory struggles have on actual contractor purchasing behavior? In a very tenuous working environment, 26% of the contractors surveyed said that they purchased more from other distributors or bought through an alternate channel altogether as a result of COVID-related circumstances. As HARDI’s Talbot Gee mentioned recently, that is roughly triple the amount of movement that one would expect to see in a typical year.

Life After COVID

As with other aspects of modern life, this survey showed that the industry is not looking at a case of getting through the pandemic and then returning to normal. That normal isn’t there anymore.

Just over 40% of contractors anticipate an increase in the amount of online business they do with their distributors, and that expectation jumps to over half in the northeast and mid-Atlantic regions. The forced adoption of electronic means and some distributors’ efforts in pushing contractors toward online processes is having an effect on long-term habits and preferences.

Related, 31% of those surveyed anticipate going into a distributor’s physical location less often. That expands to over 40% among large contractors (over $10 million) and contractors in the northeast, mid-Atlantic, and southeastern regions.

That aligns with approximately equal increases (34% overall) in alternative delivery options of all kinds. Lockers, curbside pickups, and related opportunities have gone over especially well in the northeast and mid-Atlantic, where a majority of these contractors plan to use them more often post-pandemic.

Attitudes regarding contact with distributors’ outside sales staff generated perhaps the most interesting result in the survey. An overwhelming 79% of contractors do not want any decrease in in-person visits from outside sales.

The pandemic has clearly sped up the embrace of electronic options in other parts of day-to-day business, and distributors continue to invest in them with success, but amid so much change, it turns out that higher tech is no replacement for recurring in-person visits.

Financial Impacts and Forecasts

The HARDI survey echoed what has been a common assessment about the year in business for contractors: It could have been a lot worse, and in many ways, 2020 actually turned out to be a pretty good year in strictly business terms.

The survey participants suggest that the average contractor’s business was merely flat during the worst of the pandemic in the spring, and the “essential business” designation likely helped prop up that performance.

That overall level of success hides some more specific struggles. Small contractors, who made up just over half of survey participants, reported revenue decreases of 30% or more during the worst periods.

The picture brightens when talking about 2020 as a whole. Sixty-two percent expected to finish the year with no negative COVID-related hit to revenue, and 37% see an overall revenue increase for 2020.

Even 89% of those who did report COVID-related negative impact said that they expect to have caught up by the end of summer in 2021. According to the survey’s results, medium-sized contractors (between $1 million and $10 million) sounded most optimistic, at least twice as much as small and large contractors.

Nationwide, the average contractor was looking at a 5% revenue increase over 2019. The previous year’s increase was about double that, O’Connor said.

Geographically, contractors in the Midwest and Southwest felt the most positive about year-end results, expecting 6% and 5% bumps, respectively. Northeastern and western contractors expected something closer to 4% growth. States from Michigan and Ohio down through Appalachia to Florida were least optimistic, expecting a 2% gain.

Smaller Companies, Outsized Support

Closing with some fairly good news for HVAC distributors, the survey found that HVACR independent wholesale distributors currently have 65% market share with contractors.

The rest of contractor business goes to factory stores (22%), manufacturer direct sales (6%), big box and home improvement stores (4%), and retail e-commerce (3%).

The preferences and problems of small contractors earlier in the survey weigh even more heavily for distributors in the context of distributor market share. Distributors enjoy 72% market share with this group.

By comparison, wholesale distributor market share is one-quarter smaller with large contractors (54%), while medium-sized contractors land in the middle at 62%.